Premium Finance

What is premium finance (specifically what is premium financed life insurance)?

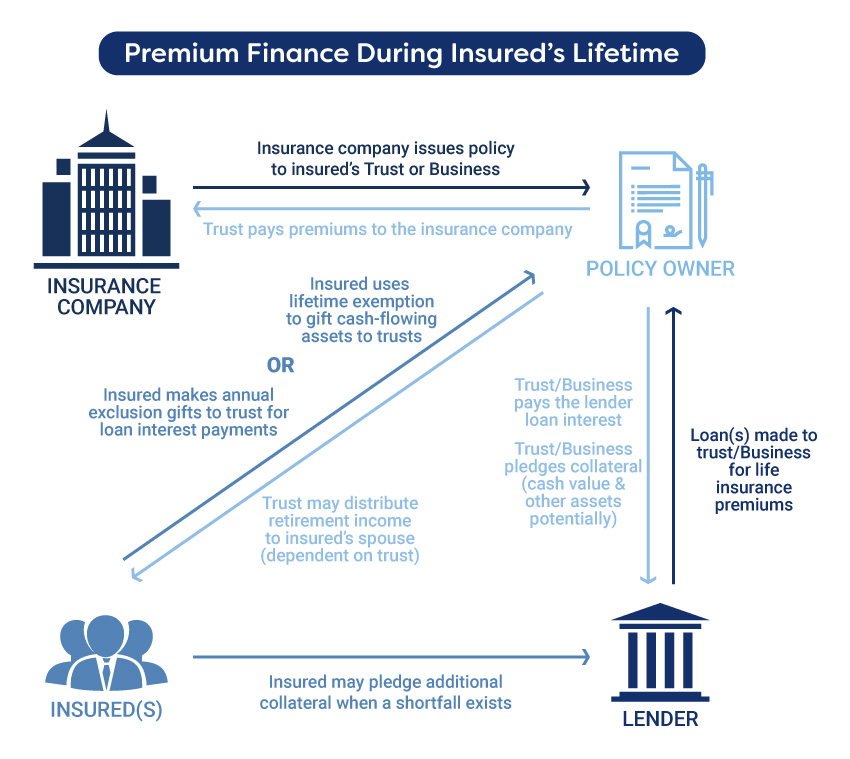

Premium finance is a strategy where policyowners will pay massive life insurance premiums in conjunction with borrowing from a third-party lender, rather than tying up their own capital. Just like how the wealthy expect extremely favorable loan terms to purchase real estate, they are often offered sweetheart loans to purchase large amounts of life insurance instead of paying premiums out of pocket.

Typically, the borrowing policyowner will make regular payments on these premium finance loans. However, some do choose to roll up or capitalize interest into their premium financing arrangement, anticipating that the cash value growth of the underlying life insurance will outperform the accruing loan interest. It is worth noting that the borrower is responsible for posting collateral whenever the cash surrender value of the premium financed life insurance policies is less than the outstanding loan balance from the premium financing.

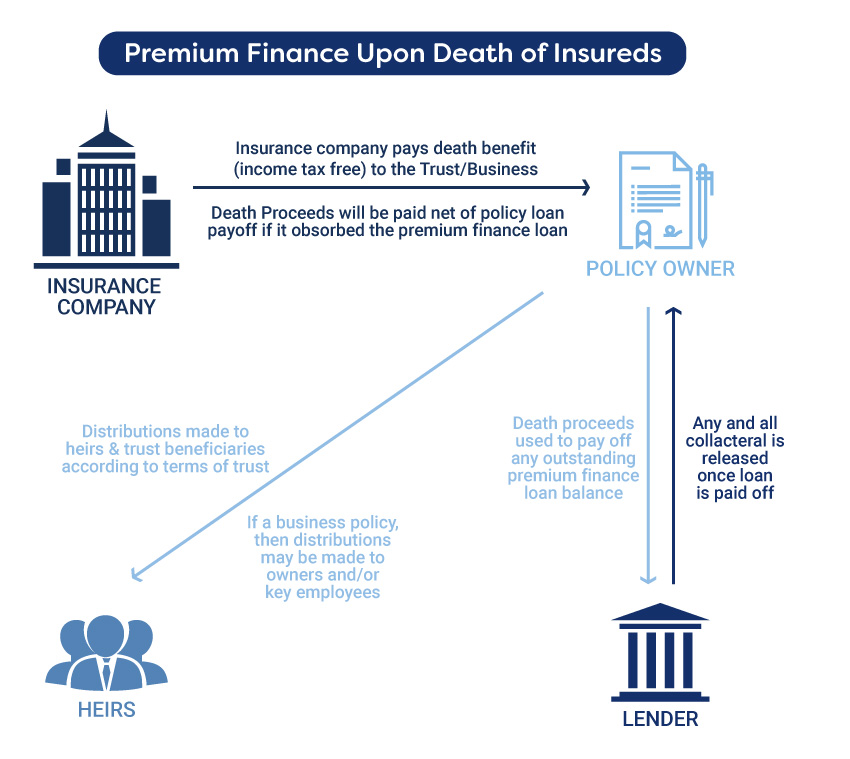

Example of how premium financing works (Flowcharts)